The IRS just announced their plans for 2012 tax season filing. Due to the last-minute fiscal cliff deal, known as the American Taxpayer Relief Act of 2012 (ATRA), the IRS will start accepting most 2012 tax filings beginning January 30. The IRS warns filing a paper return will not speed up the process. They suggest you use e-file with direct deposit for faster tax refunds.

If you have special forms (some examples – residential energy credits, depreciation, or business credits), you may not be able to file until later in February or March so they can get their systems updated.

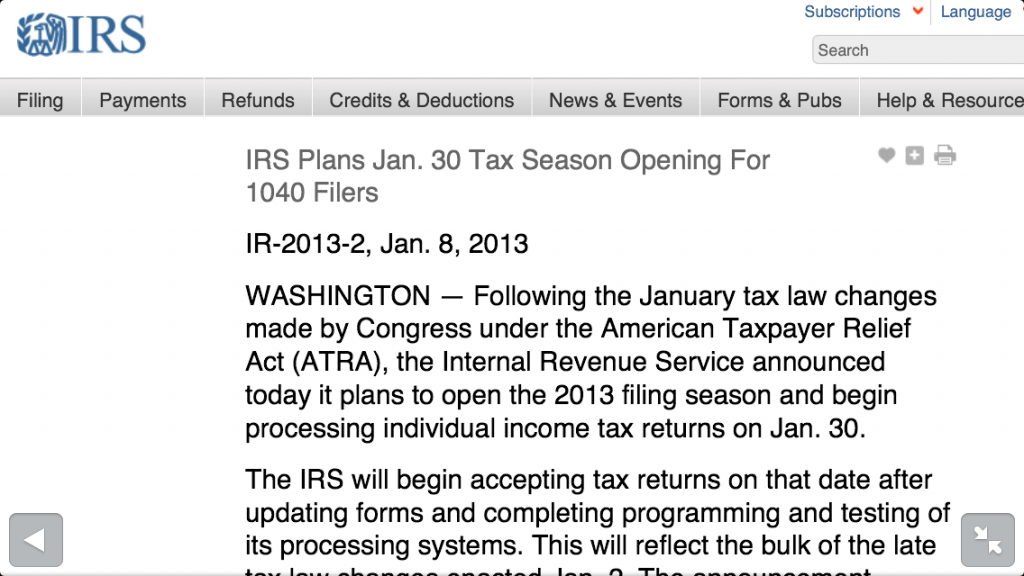

You can check out the full press release here.