Much of the rhetoric coming out of Washington DC is white noise. No one really knows what it means to them personally. To give you an idea, let’s look at the following situation.

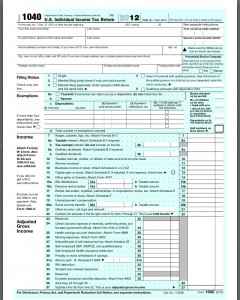

- Married couple with two children under 17 (personal exemption of $3,900 times 4 = $15,600)

- Combined wages of $100,000

- No itemized deductions (meaning they take the standard deduction of $12,200 for a married couple filing jointly)

- Taxable income equals $72,200 ($100,000 – $15,600 – $12,200)

According to the Tax Foundation (click here for the actual example), the increase in taxes including payroll taxes would be $7,650 more off the cliff or 53% increase over 2011 amounts. Would this impact this family? Yep no doubt $637.50 per month would lead to changes.

How can you calculate the impact on your family. Follow the link here to the Tax Foundation’s calculator. The Tax Foundation is a non-partisan tax research group based in Washington, D.C.