NAPFA member Tim Decker recently authored an article explaining that many CFPs are salesmen and not always working in the best interests of those they serve. This spurred my thinking about the question and the how you see my industry.

With all the credentials out there, it can become confusing as what each one means and offers. Many stakeholders in the profession may actually benefit from the confusion. The CFP credential does not imply the advisor has a fiduciary duty to you. A fiduciary duty requires an advisor to act solely in the best interest of the client at all times. All Registered Investment Advisors (RIA) are held to this fiduciary standard. However, you could have a CFP that is a broker which is different from a RIA and not held to a fiduciary standard. Confusing? Yes.

Broker-dealers are required to disclose that their “interests may not always be the same as yours.” The broker has a duty to their home office but not to you. They are held to what is called a standard of suitability. The SEC’s website defines it this way, “In making this assessment, your broker must consider your income and net worth, investment objectives, risk tolerance, and other security holdings.” Notice your best interest is missing?

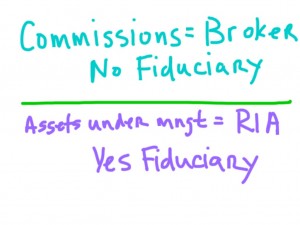

Ok – are you bored yet? I am. Bottom line is RIAs have a legally defined duty to act in your best interest and broker-dealers do not. Easiest way to figure it out is to ask your advisor how they are compensated. Generally, commissions = broker-dealer and no fiduciary duty and assets under management fees = RIA with fiduciary duty.