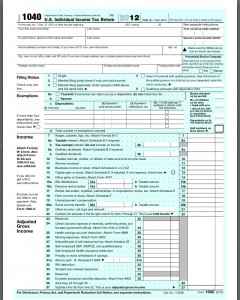

The April 2014 edition of Kiplinger’s Personal Finance magazine has a pretty good article on income tax planning opportunities. You can find it here.

The piece is especially useful because it breaks the information into sections based on life stages and concisely hits the key points.

You should pay particular attention to the income phase outs as many of the tax planning opportunities phase out at relatively low income levels.

The section on “Higher Rates” highlights the impact of the new 3.8% surtax included in the Affordable Care Act (“ACA”). This aspect of the ACA is not well understood and impacts a surprising number of taxpayers.